Commentary on current events, politics and law.

Copyright © Fred Roper 2006, 2007, 2008, 2010

Thursday, November 30, 2006

The Entitlement Mentality?

"I'm afraid we have developed an entitlement mentality as a nation. And I'm not talking about just poor people. Too many people, from the president and senators on down, expect a pension from the government. I really wish we could afford to solve their problems, but to do that would bankrupt our nation. We could ask the rich to pay for everyone, but would it solve the problem? And for how long would it even solve the problem?"with the statement:

"I agreed. Donald and I want people to let go of the entitlement mentality and become rich so they can solve the problem ... their own problem."OK, first of all, many of the reasons why people like myself are clamoring for guaranteed pensions and healthcare is because many corporations have mismanaged worker's contractually promised benefits like pensions and healthcare to the point that their actions should be considered criminal.

"The best way to solve the problem of bad financial results is to change our thoughts -- to start thinking like rich people rather than poor and middle-class people. That means losing the entitlement mentality -- whether you are a military officer, government worker, schoolteacher, employee or just poor. If we do not stop expecting the government to take care of us, we will continue to have the same results -- a bankrupt nation filled with well-educated but financially needy people.

"Albert Einstein defined insanity as 'doing the same thing over and over again and expecting different results.' In this case, it is my opinion that it is insanity to keep sending kids to school and not teaching them about money."

From pages 40-41.

The book started out so well. It seemed like they understood the problem. Instead of proposing solutions that would end the erosion of the middle class, they go off on this Socially Darwinistic tirade that everyone should just fend for themselves. They want to shift the burden from themselves (and any taxes that they would have to pay) onto the very people who now cannot bear the burden because their wealth (via pensions and healthcare guarantees) have been stolen from them (by their corporate employers not funding those very guarantees). In a sense, the corporate owners have embezzled those funds.

I understand the distinction: there was no legal obligation (other than a weak contractual one that can be eradicated in Chapter 11 bankruptcy) to fund these obligations for the benefit of the workers. But if a worker had taken the employer's money and used it for a purpose other than what the employer had designated it, he would be guilty of embezzlement.

Snowstorm!

Initially, I was a little surprised in that they acknowledge the shrinking middle class. When I bought the book at Sam's Club, I initially thought: "oh great, another 'happy talk' motivational book." So far, in the first 20 or so pages that I have gotten through, I only have a few minor critiques that hope to blog about later today.

Tuesday, November 28, 2006

Some Folks' World

by Mark Heard.

Some folks' world is war-torn

Some folks' world is fine

This planet makes no sense to the untrained mind

Some folks hope for fortune

Some folks hope to die

Each man sees his fate through his own two eyes

And when it's day to me it's night to someone

And when it's night you might not want to go on

Some folks eat what flies leave

They get what they can take

Hunger has no heart and it will not wait

Rain can ruin your weekend

Or rain can spare your life

Depending on who you are and what your thirst is like

And when it's day to me it's night to someone

And when it's night you might not want to go on

All folks' days are numbered

But most folks do not care

And no man calls his coin when it's in the air

Some folks taste of Heaven

Some folks taste of Hell

Some folks lose their taste and they cannot tell

And when it's day to me it's night to someone

And when it's night you might not want to go on

From Victims of the Age

Thanks to the Mark Heard Lyric Project

I thought about this song of Mark Heard's today as I watched the news about the developing civil war in Iraq. You could apply this to people and situations all over the world, not just Iraq. There is Darfur, Israel, Lebanon, southern Asia after the tsunamis, New Orleans after the hurricane and any number of other tragedies we hear about regularly. As we enter and celebrate the Christmas/Hanukkah season, remember those folks whose world isn't so good and pray for them.

Monday, November 27, 2006

Advice to young Chiropractor: Just Make More Money

From the article:

•Earn more money.

Schopp simply has too much debt, Cook says, for how much money she makes. She works full time as a chiropractor and part time as a personal trainer at a local gym, earning about $44,000.

"Her ability to generate more income from her W-2 job (as a chiropractor) probably isn't here," he says. But she could add personal-training clients. Schopp agrees that's a good idea.

But Cook warns that to cut expenses and increase her income, Schopp must stay focused for several years to dig herself out of her debt.

"Heather needs to be a 'no' person," Cook says. " 'Want to go out to dinner?' 'No.' 'Want to go shopping?' 'No.' She needs to have two things burned into her brain every day: watch my spending, and get a new customer. Don't spend. Get a customer. Don't spend. Get a customer."

Now get this: this is in response to a woman who works two jobs to pay her basic living expenses. TWO JOBS! Why is she in such financial trouble?

Chiropractor works 2 jobs to chip away at $165,000 in school debt.

Yea, that's living extravagantly. NOT. (Remember, this is southern California -- where living expenses are much higher.)

Has anyone ever thought about the fact that we are creating too many Barriers to Entry for the middle and lower classes to achieve financial success in life? Isn't the whole American ethos supposed to be "work hard and you will succeed?" I almost get the feeling that the amount of student loan debt that is required to get through college is becoming a kind of debt peonage system whereby here in America, the land of the free, we are devolving back to the days of slavery, but simply in a new form. We seem to be raising the cost of a degree so high that middle and lower class people cannot afford to take the risk. Ultimately, this will lead to a society that will be less competitive.

Also, has anyone thought about the policy of not allowing student loan debts to be dischargeable in bankruptcy? This also adds to the argument that student loans are becoming America's debt bondage. People are stuck owing a debt they can never hope to pay back, and yet unable to earn enough money, without some great deal of luck, to get past it.

Is this really the America that we want?

Friday, November 24, 2006

An Exercise in Poverty

From the article:

Recently, I attended a local conference regarding Financial Literacy in Oklahoma . As part of the conference they had a “poverty simulation.” The purpose was to give us some idea of what it would be like to live in poverty. I can’t say that I know what it really feels like to live in poverty because I got to end the simulation whenever I wanted. But, I can say that I learned a lot during the experience.

We were assigned an identity and given a summary of our current life situation. Stations were set up to represent the utility company, the mortgage company, a pawn shop, check cashing loan store, grocery store, and public assistance. During the simulation, I became a 19 year old, unemployed, high school drop out, single mother with a live-in boyfriend. Our bills totaled $555 per month including a mortgage on our mobile home, lot rent, utilities, food, and a car title loan that we had taken out. We also had to give transportation passes at every stop to account for the gas or the bus to get us there. Our monthly take home pay was $794.00 per month including $234 in TANF (Temporary Assistance for Needy Families) benefits and $120 in food stamps. That left us with $239 per month for everything else. Trust me $60 per week for a family of three for everything else (such as gasoline for the car, medicine, car repairs, diapers, toiletries, and other items) does not go far. Just to make it interesting we were also given several items of value to pawn if we got desperate.

Before the simulations started, I told my partner (a.k.a. my live-in boyfriend) that I knew exactly what we were going to do. We would pay our bills by priority in order of importance (housing, food, car, utilities and then the car title loan). In my real life as a credit counselor, that’s exactly what we teach people to do. I also informed him that we would not go to the pawn shop at all. I knew that I was going to fly through this exercise with no problems. I am a money management expert, right?

It was amazing to me how quickly my priorities changed. In a matter of minutes I transformed from the calm budgeting expert who had it all figured out to someone who was just living in survival mode. Much of my reason and logic went out the window. I could not pay the mortgage first as planned because we only took home $110 per week from my boyfriend’s job. It was 3 weeks before we had enough to pay the mortgage. In real life, I tell people to pay their mortgage first since we want them to avoid homelessness. In the simulation, we paid the mortgage next to last and had been evicted by the time we came up with enough money to pay it.

In real life I advise people to avoid paying high fees for services such as check cashing and to stay away from the pawn shop. Logic would tell you that it is much cheaper to open a checking account at the local bank or credit union than to pay fees for check cashing services. In the simulation, we did not have a bank account and could not obtain one. In order to cash my boyfriend’s check to get money to pay the bills, we had to pay a $10.00 fee for every check we cashed. When we got a cut off notice for the utilities, I found myself in line at the pawn shop to hock my stereo. I took the money from hocking the stereo to pay the gas bill just before they cut it off. I also had to stand in a long line at the public assistance office just to confirm my TANF benefits. I had to take my baby with me since I could not afford daycare. I stood in line for so long that the office closed and I had to come back the next day. I witnessed another single mom making her sick child stand in line with her because she had no other choice. She could not afford daycare and the child could not go to school when she was sick.

It was so amazing to me how quickly I changed my priorities during this exercise. In reality, it is pretty easy to sit behind a desk and tell people what they “should” do with their money. When you have extra money, it’s easy to talk about all of the responsible things you should do with it. I guess it’s the financial equivalent of armchair quarterbacking. In my job, I recommend the logical, money saving way to live. However, when I found myself in the situation of not having enough money to take care of my family and keep from getting evicted, I just did what I could to survive. If a station forgot to ask for my transportation pass (we were required to give them at every station) I didn’t offer it. I just kept it and hoped to get through the transaction without having to give it up. When the gas bill was due and payday was days away, the pawn shop looked like a pretty good option. When the problem of no checking account stood between me and getting money, I did not care that I had to pay the $10 fee for every check. I just needed the money.

Read the rest of the story at the title link. It should make you think twice about our public policy of purely letting "the free hand of the market" set wages.

Black Friday shopping

Besides Quail Springs Mall and the Wal-Mart Supercenter/Sam's Club, other shops in the area include Ultimate Electronics, Super-Target, Circuit City, Barnes & Noble, Toys R Us, Office Depot, Old Navy and a few others. None of them seemed packed. But maybe that is just me. My experience is just anecdotal, but it didn't seemed to me that sales were all that brisk. What makes me think that sales were down is that the Quail Springs Mall area is also the middle-to-upper class part of Oklahoma City, so if sales aren't up in that part of town, it probably isn't up anywhere else.

I am curious what everyone else's experience is like. There is a lot of talk that there will be more online shopping this year, and I will probably be doing some of that myself. I'll be watching the numbers on Monday to see if my experience bears out everywhere else.

***Update***

Well, I just came from the south side of town. Best Buy and Crossroads mall were about 50% busier than normal. So maybe I was just in the wrong part of town. It still isn't quite as I remember from Christmas' past, but not too bad.

Tuesday, November 21, 2006

And in the You've Got to be Kidding Me Department...

Health care, at its most basic levels, has two justifications:

1) it is a charitable dispensation of kindness to someone at their when they are their weakest and in the most need; and

2) it is designed to increase the efficiency of a soldier or worker so that, once healed, can produce or fight another day.

For these reasons, the guarantee of access to health care has both a faith-based and secular efficiency-based justification. Certainly there are issues of how many societal resources can expend in treating illness and injuries; but the central and fundamental basis for the creation of a national health care system should not subject to argument. And what is truly shocking to me is that those who would proclaim their Christian faith the loudest would be the most obstinate in supporting health care for all.

New M3 Money Supply Reported by Big Picture Blog

What we have now found is that the M3 money supply has been inflated during the time that the government did not report the data. This, I think, leads to inflation concerns. If I am reading the reports correctly, that means that real inflation is running at about 10%, which is much higher than the official CPI numbers of 3%. However, I am going to defer to people who are much knowledgeable about this than I.

Monday, November 20, 2006

Report in USA Today shows Oklahoma home prices still going up

Bubble? What bubble?

College Graduates are Struggling with Debt

Nearly half of twentysomethings have stopped paying a debt, forcing lenders to "charge off" the debt and sell it to a collection agency, or had cars repossessed or sought bankruptcy protection.

High debt loads are causing anxiety, too. A poll of twentysomethings by USA TODAY and the National Endowment for Financial Education (NEFE) found 60% feel they're facing tougher financial pressures than young people did in previous generations. And 30% say they worry frequently about their debt.

"I have nightmares," says Heather Schopp, 29, of Long Beach, Calif., who accrued $165,000 in student-loan debt to become a chiropractor. "I dream I'm on a hot-air balloon, hanging on for dear life."

Among all twentysomethings, the fastest-growing group owes $20,000 or more in student-loan debt. Though it's a small group, its proportion has doubled in the past five years to 3%.

"This debt-for-diploma system is strangling our young people right when they're starting out in life," says Tamara Draut, author of Strapped: Why America's 20- and 30- Somethings Can't Get Ahead. "It's creating a sense of futility that no matter what they do, they're not going to be able to get ahead. It's a sense of hopelessness."

A change of plans

Debt has forced some young people to change their career plans. Of those surveyed, 22% say they've taken a job they otherwise wouldn't have because they needed more money to pay off student-loan debt. Twenty-nine percent say they've put off or chosen not to pursue more education because they have so much debt already. And 26% have put off buying a home for the same reason.

A smaller percentage say they've put off marrying (11%) or having children (14%).

The Boomerang Generation — young adults who return to live with their parents — is real, too. In the poll, of 910 twentysomethings, 19% said they've moved back with parents to cut costs. The 2000 Census found that more than 25% of 18 to 34-year-olds had moved back in with family at the time the Census was taken.

Yep, this is what you call the "ownership society." American college graduates are owned by their education debt.

What are the reasons for this problem? Again, from the article:

What exactly is tougher about the financial challenges facing today's young adults? Shireman of the Project on Student Debt points to:

•Skyrocketing tuition. The average price of college has grown much faster than the rate of inflation. Average annual tuition at public four-year colleges and universities is $5,836 in 2006-07, up 268% from 1976-77, according to the U.S. Education Department and the National Center for Education Statistics. Private college tuition is up 248% to $22,218 a year.

•Declining student grants. Though total federal student aid has grown sharply, so has the proportion of people in college. In 2004, 67% of high school graduates enrolled in college; in 1972, only 49% did. As a result, student grants cover only 39% of the costs of a four-year college today, compared with nearly 80% in the mid-1970s, the College Board says.

•Soaring student-loan debt. Students have generally made up the gap between what colleges charge and what they can afford by borrowing. The percentage of students who borrowed for college jumped to 65% in 2000-01 from 34% in 1977, the National Center for Education Statistics says.

And they use credit cards to help pay for books and other items. Half of all graduates in 2004 used credit cards for school expenses, the American Council on Education found.

•Flat wages. Once students graduate, jobs don't pay what they used to.

Thirty years ago, a male college graduate could make the equivalent of $51,223 a year in 2004 inflation-adjusted dollars. In 2004, he earned less: $50,700, according to the NCES. Wages for women, though, have risen.

•Rising home prices. It takes a greater portion of the average income to buy a median-price home today. In 1970, it was 17%; in 2005, 22.4%. The median price of a home was $23,000 in 1970. Adjusted for inflation, that's $115,770 — barely more than half the median price of $219,000 in 2005.

"Twentysomethings now are crunched in ways older people were not," says Cathy Stocker, co-author of The Quarterlifer's Companion, a book for twentysomethings. "The cost of education has far outpaced income, and housing costs have skyrocketed. They're crunched from all directions."

For more information on how this all fits into the Big Picture, see my previous posts here and the Warren Reports generally. Just click on the Warren Reports tab for more articles.

Bankrate.com on what we can expect from a Democratic Congress

Saturday, November 18, 2006

Friday, November 17, 2006

The Drift Towards a Class System by Jim Webb

Thursday, November 16, 2006

Too Many Voices

Of course, I just had to add to the chatter of too many armchair pundits adding their two cents worth on the issues of the day. So I have a lot of room to talk, don't I?

Of course, the founding fathers of the United States always intended for there to be a clash of the cacophony of ideas among the participants in the political process. At the same time, the virtual smorgasbord of sources of information is almost too much to handle.

Although I suppose its better than the alternative. I would rather have access to all the information out there that allows me to make an intelligent decisions about politics, investments or any other interest I have. So maybe there aren't too many voices after all.

Is Whitney Houston Heading for Bankruptcy?

Wednesday, November 15, 2006

An interesting legal argument against credit card contracts

From the comment:

Moreover, if you read my prior post on this subject that (linked to above) you'll notice an even bigger problem: the changed contractual terms typically

apply retroactively to balances you already carry. Your comment references this point and suggests that it should be against the law, but it currently is considered acceptable practice. In other words, if you have a $5,000 balance and the credit card changes your terms to say that your 0% promo rate is bumped to 29%, your late fees increased twofold, and your minimum monthly payments doubled, these changed terms apply to the balance you already carry. Using our imagination again, pretend you went to the store and purchased a CD for $10. How would you respond if the store called you a week later and demanded an extra $5 for the CD long after it was purchased? Applied to credit cards, imagine you want to purchase a $3,000 flat panel television but don't have that much cash on hand. You calculate that you can afford an additional $250/mo., so you sign up for a credit card with a 0% promotional APR for one year and purchase the television with the expectation of making those payments for twelve months until the balance is paid down. One month in, your credit card company terminates your promo rate and hikes your standard APR to 20%. Suddenly, your purchase price for the $3,000 television just jumped to $3,600 (ignoring compounding penalties and fees), long after you made your purchase.

One final point. I would argue that this isn't a contract at all. If every single term of the contract is subject to be altered or removed at any time, upon the unilateral action of one party, then what terms did I agree to? The law has a name for this, and it's an "illusory" contract. An illusory contract appears to be a contract but in fact is not legally enforceable because it lacks at least one essential aspect of a contract; in this case, it's lacking all aspects of a contract because there isn't a single term written in stone that can't be changed at the whim of the party. In the simplest sense, this is no different than a "contract" that

states only "I'll give you $10 if I feel like it," which is no contract at all.

The Ugly Truth about Health Care

Delbert Davis lost his job, and with it, his health insurance. During the three months he was unemployed, he was diagnosed with cirrhosis of the liver. With no health insurance, he was denied the ability to be placed on an organ transplant list.

James Kvaal over at Warren Reports at Talking Points Memo comments:

Davis fell right through our safety net. Medicare wouldn't cover him for two years, and he didn't have two years. He wasn't poor enough for the county health program. He couldn't afford the premium for the state program, and anyway it would make him wait a year for the surgery.(Editorial comment: Talk about "family values!")

With a little more time, he might have been helped by a special Medicaid program (which would have required him to get divorced, by the way).

But he didn't have time. Davis died on October 20.Now I realize that having a national health care system would not completely solve this problem, but it would help. Another problem is the lack of available organs for transplants. (If you haven't checked the Organ Donor on your driver's license, now would be a good time to do it.)

His widow, Ann Davis, is left with $1,875 a month in medical bills and is afraid she will lose her house. She told the Austin paper, "My husband and I have worked hard all of our lives. We had insurance up to a very brief window of time: three months that we didn't have coverage, and this happened. Just that little lapse of time . . . and we were trapped in a spiral that we couldn't get out of."

Hard to believe that losing a job can be a death sentence, but that's how messed up our health care system is.

In any case, stories like this where people lose everything they have due to medical bills is just insane. This is just another anecdotal example of why we need a national health care system.

Tuesday, November 14, 2006

Blue Man Group Concert Review

As I watched the show, there was a segment about the enormous amount of information that we have access to now. During this part of the show, there was a screen that scrolled three lines of text. It goes across so fast that you would be lucky to read just one of the lines. I decided to pick the top line and just read it. It talked about how just one page of a modern newspaper contained as much information as what an entire paper from the 1700's would have. It also gave some statistics on how much information is contained on the internet every day compared to previous years.

It made me wonder: with all this information that we are bombared with, are we suffering from "information overload?" There are many days that I feel that there is too much information. What I mean by that is that I don't have enough time to keep up with it all.

Anyway, there is also a segment where they spoof U2's Bono and The Edge and their pushing certain causes. Anyway, the segment did a serious take on global warming (with some humor thrown in).

If you get a chance to see the show, it is one of the better ones.

Sunday, November 12, 2006

Saturday, November 11, 2006

Experts Think Bankruptcies About to Rise

Is this the cause of rising real estate prices?

A federal indictment unsealed Thursday accuses home buyers, real estate sales people and a mortgage broker — seven people in all — of wire fraud, money laundering and other offenses in attempts to defraud lenders in buying homes in Edmond's upscale Oak Tree addition.

The seven committed fraud by "artificially inflating the sales prices of homes and submitting false loan applications," the indictment alleges. "Each of the defendants intended to personally profit by funneling substantial sums of money back to themselves and others from the excess sales proceeds under the guise of remodeling, repair costs or marketing service fees."

Friday, November 10, 2006

Is Asset Dependence our problem?

Another Good Post from the Warren Reports

Lonely One

by Mark Heard

Hard times inside you

I have seen you crying

Lonely one

Dry eyes can't hide you

When the truth draws nigh

Lonely one

you're such an actress

Smiling with your makeup

Lonely one

you're out of practice

And smiles are hard to fake

You're not in love, not even with your lovers

You've thrown your heart to the wind

Oh lonely one, when will you ever bother

To reach for the hand of a friend

Lonely one

Run from the shadows

Darkness lies in waiting

Lonely one

You know it matters

That you find your way

Oh lonely one

Lonely one

No one to talk to

Cords of silence bind you

Lonely one

Gentle whispers call you

Seek and you will find

Oh lonely one

Oh lonely one

From Stop the Dominoes Thanks to the Mark Heard Lyric Project

A beautiful song, to be sure (the lamenting melody with the fiddles adds to the effect); but compare his more developed song with the lonliness theme later:

by Mark Heard.

She was trapped in a photograph

chorus:

She was the captain of her maiden flights

chorus

How she wishes she could strangle time

chorus

All the Lonely People

What struck me in the article is how all of the districts with the highest percentage of married people went to Republicans and how all of the lowest percentages went to Democrats and how many of the battleground districts were ones where the number of married and unmarried districts approached 50%.

When I first began the thought of writing this post, I wanted to simply point out how we are marrying later. It is a trend that is developing, and I am curious as to its causes. From an article in the Christian Science Monitor:

As the US moves toward 400 million people, Americans can be expected to marry later in life, and more of them will live alone. Between 1970 and 2005, the median age of first marriage moved from 23 to 27 for men and from 21 to 26 for women. Over the same period, the percentage of single-person households grew from 17 percent to 26 percent. Those trends are likely to continue.

Another trend that is likely to continue: marriages that are "'Til Debt Do Us Part" as this article in USA Today indicates. From the article:

Money conspires to antagonize couples. It sometimes invites divorce. And though finances have always raised tensions for couples, it may be harder than ever these days to avoid conflict.

That's because today's range of family complications — moms leaving and re-entering the workforce, late marriages that bring debt and adult children, shrinking pensions and baffling health care choices — are demanding ever-more financial decisions from couples who can't even agree on whether the house is warm or cold.

...

There's a big problem, though: The USA is a nation of spenders, not savers. The personal savings rate is negative, meaning Americans spend more than they earn. And the portion of disposable income going toward paying down debt — including mortgage and credit card debt — is near a record high. Households with at least one credit card carried an average of $9,498 in card debt in 2005, nearly twice the level of a decade ago, according to CardWeb.com.

I still remember lawyers who talk about "how we used to fight over assets, and now all we fight about is debts." It not quite true, but it is not far off, either.

What the Republicans don't understand is this: those financial policies of maximizing profits at the expense of the working class is tearing into the very moral fabric of the married couples that make up their districts. Can the Democrats take advantage of the void left behind?

Thursday, November 09, 2006

Editing My Blog

Wednesday, November 08, 2006

Here is another BlogThings test

| You Are Incredibly Logical |

Move over Spock - you're the new master of logic You think rationally, clearly, and quickly. A seasoned problem solver, your mind is like a computer! |

What kind of Blogger are you?

| You Are a Pundit Blogger! |

Your blog is smart, insightful, and always a quality read. Truly appreciated by many, surpassed by only a few |

Hornets Leading Their Division

...

The Hornets improved to 4-0 for the first time in franchise history with a 97-93 victory over Golden State. The Hornets followed their home-opening victory in New Orleans by winning their opener in Oklahoma City to join 4-0 Utah as the NBA's lone unbeatens.

They refuse to get ahead of themselves, either.

"We're still trying to build an identity," Chris Paul said. "It's only four games into a new season. It's still possible for us to finish 4-78. You never know."

...

Paul had 22 points and 11 assists while running the Hornets' balanced attack. Peja Stojakovic scored 18 points, David West had 16 points and 11 rebounds, and Desmond Mason added 12 points. Tyson Chandler had 10 points and 14 rebounds.

"You can't key on one guy with our team," Paul said. "Some teams have a guy that down the stretch they're going to go to that guy every time. With our team it varies."

The Hornets stayed in the Western Conference playoff race deep into last season, and were expected to contend for a spot this time after acquiring Stojakovic and Chandler over the summer.

"I think every player on the team is getting more confident when we step on the floor that we can get the job done," Mason said. "Even in tight situations we're getting it done. Last year we didn't do that. Last year we kind of fell flat a little bit in those situations down the stretch. We couldn't make plays."

_______________________________

Yep, now that the Hornets are in Oklahoma City, they are doing much better.

Oklahoma Election Night Watch Party 2006

The Republicans ended up tying in the Senate (24-24), but because the Democrat, Jari Askins, won the Lieutenant Governor's position, she will cast the tie-breaking vote. The Lieutenant Governor's office was vacated by Republican Mary Fallin, who won Oklahoma's U.S. House District 5, replacing Republican Earnest Istook, who was crushed by popular Democratic Governor Brad Henry in his reelection bid.

I personally was more interested in the national races than the state or local ones. I had to hijack one of the three TVs in Dr. Hunter's room so I could keep up with the national races. All of the other TVs were tuned to the local races. If the current numbers hold up, it appears that the Democrats will control the U.S. House and Senate.

I went from room to room for all the candidates to see how all of them were doing. Of all the Democrats there, only one lost (Cody Graves, who was challenging for Oklahoma's Corporation Commission against Bob Anthony, who won a lot of public support in the early days by wearing a wire for the police when a lobbyist tried to bribe him -- but even he came surprisingly close).

It really got festive at about 11pm when the final precincts came in for the District Attorney's race for Oklahoma County. With 30 precincts left, word came that the Democrat, David Prater, was 2000 votes short against the Republican incumbent Wes Lane. However, the precincts that were still out were from eastern Oklahoma County in predominantly Democratic areas. With 3 precincts to go, David Prater pulled ahead by 300 votes. Prater, eventually emerged on top by 824 votes out of almost 175,000 cast. The room (and hallway, and foyer down the hall) erupted in celebration. The funny thing is that Prater had the smallest room of all the candidates, but it seemed like he had the most people watching the results. You couldn't hardly get in or out the room by the end (it wasn't easy even before that). After the announcement of the final results, we heard that the incumbent would be asking for a recount.

Oklahoma uses the electronic voting machines that scan paper ballots. The ballots are easy to read and can be hand-counted if necessary. So, the final result will have a high degree of certainty. So, unlike the concerns about the Diebold machines in other states, Oklahoma's elections won't have doubts about the outcome(s) if a recount is necessary.

Overall, it was a good night for the Democrats -- even in Oklahoma.

If you are interested in more results from the Oklahoma election, you can find them at the Oklahoma Election Board site.

Monday, November 06, 2006

Progressive Christians Uniting's take on the Ted Haggard scandal

Mortgage debt increasing for people seeking bankruptcy

From the article:

“Mortgage debt is coming out as much more significant than we expected,” Ms. Keating said. “Pull this all together with the other unsecured debt people have, and this is really problematic.” The foundation, she added, will intensify its attention to mortgage counseling over the next year, partly in anticipation of more demand from consumers whose home loans are growing more burdensome.

The foundation has been surveying its members to gauge the effects of a federal bankruptcy law signed last year, which, among other things, eliminated some benefits of personal bankruptcy filing.

I'm Crying Again

Evangelical Christians seem to be turning into modern day Pharisees. Some day I am going to do a post that spells out the similarities line by line.

I don't know if Christians getting involved in politics must become hypocrites by necessity, but it sure seems like those who preached piety in public life the loudest and attained the greatest amount of political power have been exposed to be the biggest hypocrites -- preaching discrimination against sinners, while committing the same sins in private. I remember hearing something about "don't point out the splinter in your neighbor's eye while ignoring the log in your own."

As I posted before, there are four basic corrupting influences. Politicians -- even Christian ones -- are susceptible to the corruption of power. Jesus said "you cannot serve God and money." You can say the same about power.

by Mark Heard.

The headlines in the dailies are the horses in a race

They lead you to believe that life and death are commonplace

Some believe it

And I'm crying again

I heard some good intentions and not all were second-hand

But bravado and pretension will not feed a hungry man

It's been said before

And I'm crying again

Very quietly

The world loses blood overnight

Without a fight

In the morning

The sickness will hide in the light

Out of sight

Running from a world that they will never understand

The masses ride their passions with the throttle in their hands

Nobody knows

What is waiting around the bend

Now and then the criminal in my skin lets out a sigh

He'd like to think he's innocent

But he cannot tell a lie

Truth is like a knife

And I'm crying again

From Stop the Dominoes Thanks to the Mark Heard Lyric Project

The Internet Monk on "The Passion of Haggard"

"I am suggesting, therefore, that the increasing interest in the culture war among evangelicals is not an example of a reinvigorated evangelicalism remaking its culture. Instead, I believe the intense focus by evangelicals on political and cultural issues is evidence of a spiritually empty and unformed evangelicalism being led by short-sighted leaders toward a mistaken version of the Kingdom of God on earth."

"Evangelicals love a testimony of how screwed up I USED to be. They aren’t interested in how screwed up I am NOW. But the fact is, that we are screwed up. Then. Now. All the time in between and, it’s a safe bet to assume, the rest of the time we’re alive. But we will pay $400 to go hear a “Bible teacher” tell us how we are only a few verses, prayers and cds away from being a lot better. And we will set quietly, or applaud loudly, when the story is retold. I’m really better now. I’m a good Christian. I’m not a mess anymore. I’m different from other people.

What a crock. Please. Call this off. It’s making me sick. I mean that. It’s affecting me. I’m seeing, in my life and the lives of others, a commitment to lying about our condition that is absolutely pathological. Evangelicals call Bill Clinton a big-time liar about sex? Come on. How many nodding “good Christians” have so much garbage sitting in the middle of their lives that the odor makes it impossible to breathe without gagging. How many of us are addicted to food, porn and shopping? How many of us are depressed, angry, unforgiving and just plain mean? How many of us are a walking, talking course on basic hypocrisy, because we just can’t look at ourselves in the mirror and admit what we a collection of brokenness we’ve become WHILE we called ourselves “good Christians” who want to “witness” to others. Gack. I’m choking just writing this."

"Many of today’s pastors are entrepreneurs, not spiritual men at all. [They] are running organizations, living in front of an audience, talking about style and technology. They are shallow, ambitious and over-worked. Their families are on the stage. They are supposed to fill a dozen major roles. They are celebrities and motivational speakers."

A very interesting post by MaxedOutMama

MaxedOutMama is a regular poster at Calculated Risk.

P.S. I noticed that CR mentioned me in his post today. If you are here from Calculated Risk, Welcome!

Sunday, November 05, 2006

New Real Estate Ads in OKC

Compare this to news coming out of Key West, Florida (from Mish's site, see links on the side of page) from poster FreeThinkerKW:

As longtime readers of this board know, I live in Key West where Real Estate tripled, quadrupled, and quintupled in the past 6 to 7 years. I alerted this board to the most unprecedented "happening" in Key West in my 16 years down here which took place yesterday, Saturday: an attempt to sell 22 homes at auction in a stalled real estate market.

Last week in Key West, only 1 home sold. The week before, 2 homes sold. The week before that either 2 or 3 homes sold.

Mind you that we now have 1400 to 1600 homes on the market, depending on the source of your information. Know too that there are approximately 300 to 600 homes being sold by owner which are not even listed in the MLS.

If we sold 2 homes a week in Key West, this inventory would last, oh, about 14 to 19 years at this rate. And as you will read, the asking prices of these homes are so out of reach for most people that the sellers must now face either foreclosure or drop their prices even more rapidly than they have already dropped.

I am about to lay the results on you from yesterday's auction. I am hoping you will be able to read the entire article without the Key West Citizen truncating it. If you cannot read the entire article, let me know, I'll send it to Mish, and then he can post it on his blog.

I can hardly wait. What I wouldn't give to be a bankruptcy attorney in Key West right now.

Anyway, Mish's Friend goes on to post:

Furthermore, I know someone mentioned in this article. I will not divulge his name as I don't want someone to google a reference to this auction and then they see my post come up alluding to his pain with his name prominently displayed. I don't want to add to his embarrassment and dismay. But I will say this: his remarks to the paper are not what he is telling me personally.Mish posted a link to the article (free registration required). But he posted a significant amount so that you probably get a pretty good picture of what happened.

This builder is so underwater with unsold homes that he recently put his own luxury home on the market. He also has 7 brand new homes up on Stock Island, the next island up from us. Those homes, when first completed, were on the market for $550,000 to $700,000. They are on the market now for $400,000 to $500,000 with no lookers whatsoever. He might get lookers at $250,000. And he might actually get some buyers in the sub-$200,000 range, IMHO.

So, I wonder how long it will take to reach Oklahoma?

Locals Weather News

Speaking of weather, it has been noticeably quiet on the hurricane front this year compared to last year.

New video by Amnesty USA

I don't agree with everything Amnesty International believes in, but I do like this ad.

Friday, November 03, 2006

I voted today.

Now I just have to wait for the election returns Tuesday night.

Wherever you are, don't forget to vote!

Man, talk about a fuel-efficient car!

Thursday, November 02, 2006

The Seasons of Life

In spring, new life starts. Caterpillars metamorphosise into butterflys. Everything is in bloom. The plants and flowers come to life. Everything is vibrant. We are born, having metamorphosised from a simple organism in water to we come out of own cocoon into the air, spreading our own wings. We plant the seeds and we weather the storms. When we are young, we quickly learn new things; we explore the world around us and our bodies and minds grow rapidly.

During the summer everything is green. The fruits of the plants and trees begin to develop. The insects and animals are hard at work. As humans, we toil and begin to produce. We struggle and jockey for our position in life. We move beyond the confines of our youth and stake out our territory. The lucky ones marry and start a family.

Here I am entering what would be the fall of my life as I think about these things. It is a time for harvest. It is a time when we generally are at our most productive. We store the harvested food for the winter that is to come. It is a time to reminisce and think about the seasons past and prepare for the cold that is setting in. During the fall the plants and trees begin to break down as they lose the green of summer. Yet, there is a beauty of the changing colors.

by Mark Heard.

Cast away the tether lines

Can the loner stand alone

All the ageless seasons

All the lovers

Can the loner stand alone

During the winter the flowers have withered away and the trees have lost all their leaves. The landscape is cold and gray. Because of the cold, we move slower. Our bodies hurt. Soon the winter of life overtakes us, and we return to the ground.

Sometimes I wax philosophical like that. I guess one of the reasons that I liked Mark Heard's music was that his music expressed the human condition in a realistic way -- unlike much of Christian music today. It was poetic and thoughtful, while still expressing a Christian worldview. I guess I see a lot of my own thinking in his art.

As an interesting note, there seems to be a disproportionate number of his fans who became attorneys. Go figure.

Early Voting Starts Friday in Oklahoma

You can vote early at your County Election Board office on these days:

Friday, November 3, 8 AM – 6 PM

Saturday, November 4, 8 AM – 1 PM

Monday, November 6, 8 AM – 6 PM

All regular polling places will be open Tuesday, November 7, 2006 7 AM – 7 PM.

Wednesday, November 01, 2006

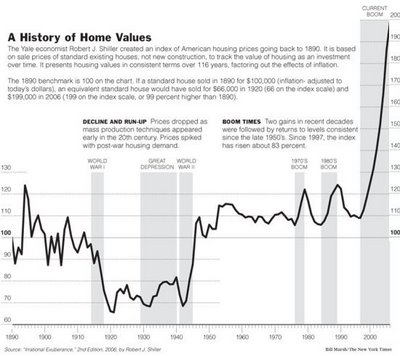

More on this chart at the Of Two Minds Blog today

Of course, most of this pain is going to be felt on the coasts, where the Of Two Minds blog hails from. I live in a 1700 square foot house with almost an acre of land. I am thinking that my house would probably sell for $85,000, tops. That is like $50/sf. It is possible I am undervaluing it -- but not too much. In the nicest parts of Oklahoma City, prices go up to $80/sf. Compare my house to what you would find in California or Florida now. Look at these charts from the View from Silicon Valley blog (near San Francisco, CA). Look at the price per square foot. Condos are selling for about $450/sf and houses are selling for close to $500/sf. That is ten times what you would pay for a house here (or 6x what you would pay in the best areas of Oklahoma City).

Are incomes there six times ours here in Oklahoma? (Wait! Don't answer that!) I guess it's possible. Charles Smith of the Of Two Minds blog told me that an average waitress at a restaurant in Silicon Valley makes what an average attorney makes here in Oklahoma City. No wonder he needs to sell so many of his books.

For more good charts on the housing bubble, see this.