I decided to go shopping yesterday, and then watch of the OU-Nebraska Big 12 Championship football game. (For those of you who visit this site from out of the country, that is

American football, which is similar to rugby -- not soccer.)

Anyway, I did a little more reading of the Why We Want You to Make Us Richer, er, I mean,

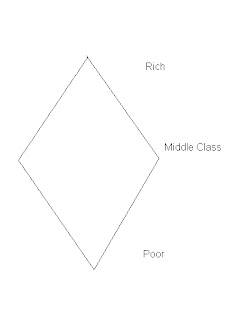

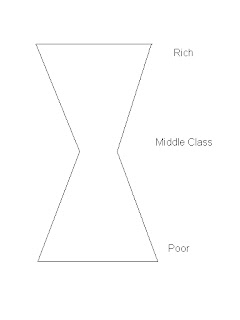

Why We Want You to be Rich by Donald Trump and Robert Kiyosaki. In it, on page 46, Mr. Kiyosaki refers to a Changing Demographic of the American populace. He claims the American populace is changing from a rhombus-shaped society (I was planning to upload some images to assist me, but Blogger is not working right for some reason) to an hourglass-shaped society where there are many rich and many poor, but few middle class.

***Update*** Blogger seems to be working again.

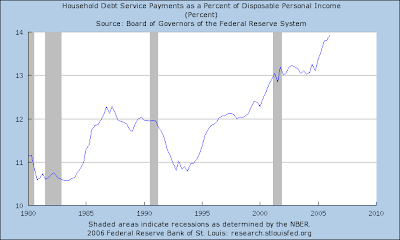

I think he has the wrong shape. We are turning more into a triangle-shaped society. There are still relatively few rich, but there are more poor and fewer middle class. Many of the middle class are sinking into the lower classes. But the number of middle class Americans that are rising to the upper classes -- even upper middle classes -- is not increasing at same rate as those falling into the lower classes. In fact, you would be hard-pressed to show that the percentage of middle class Americans that are moving up is increasing at all.

Mr Kiyosaki goes on to say on pages 47-48:

The problem is our nation is filled with people like my poor dad -- a good man, well-educated, hard-working, yet expecting the government to take care of him when he retired.

He then says that all the money that the baby boomers contributed to Social Security has "disappeared into a Ponzi scheme."

What a canard.

I, for one, cannot figure out what is so wrong with creating guarantees for workers who have worked all their lives so that they can live out their last days in relative financial security. Not everyone can become a CEO, top athlete, movie star, a Senator or a big-business owner. Many people are quite content to be your Average Joe;

and there is nothing wrong with that. The fact is that very few people are cut out by genetics or training for greatness.

Mr. Kiyosaki is starting to come off in this book as a snooty and pretentious elitist. The fact is that one of the best and most stable retirement guarantees is Social Security. It is not like the President of the United States and his administration can filch the Social Security funds like Enron or Worldcom executives did with their employees retirement funds.

Before you throw eggs at me, I realize you could argue that Congress is spending the Social Security money irresponsibly to lessen the current account deficit. But that is not quite the same as dumping the very stock in a company that you own while at the same time telling your employees to buy the stock with their retirement money.

It is this very type of graft that discredits Mr. Kiyosaki's argument to make everyone responsible for their own retirement. What we need, if we are to keep retirement plans private and encourage people to invest their money, is to have laws that strengthen the ability to recover money that is misappropriated.